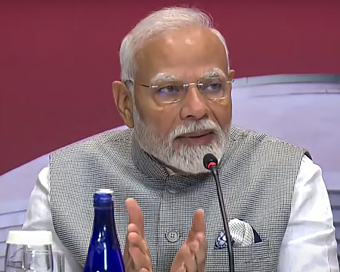

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

Will reach out to industry from April 1 on GST awareness: Jaitley Last Updated : 01 Feb 2017 01:52:52 PM IST

(file photo)

Finance Minister Arun Jaitley on Wednesday said the government was ready for implementation of the Goods and Services Tax (GST) and will begin reaching out to the industry from April 1 to make them aware of the new tax regime.

Jaitley however did not spell out the likely date for implementation of the new indirect tax regime.

" GST Council has finalised recommendations on all issues, the preparedness of IT is on schedule. On April 1, the reaching out to the industry will begin to make them aware of the new tax system, as per schedule," the Finance Minister said while presenting the Union Budget 2017-18 in the Lok Sabha.

"Preparatory work on GST is top priority of the government. Several teams of the Centre and states are working towards it," he added.

He said he was not making too many changes in the excise and customs as they will be soon replaced by GST.

He further said the implementation of GST will bring in increased revenues to the Centre and states and spur competitiveness.

The GST Council held nine meetings to discuss the tax rate, threshold exemptions, compensation to the states, draft laws and administrative mechanism, among others.

The Finance Minister had earlier said that July 1, 2017, appeared to be a realistic option for implementing GST. The earlier implementation date was April 1, which is fairly out of the question after the GST Council resolved all its issues only by January 16 this year.

The Centre and the states agreed on a formula to resolve the issue of cross-empowerment and dual control under the Goods and Services Tax regime.IANS For Latest Updates Please-

Join us on

Follow us on

172.31.16.186