PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

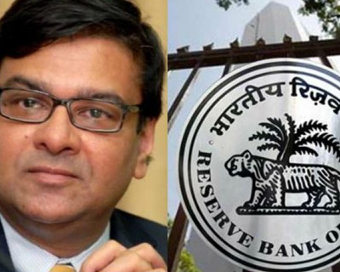

RBI keeps policy rate intact; stance unchanged Last Updated : 05 Dec 2018 04:23:51 PM IST

RBI keeps policy rate intact; stance unchanged (File photo) In its penultimate monetary policy review of the current fiscal, the Reserve Bank of India (RBI) on Wednesday kept its key lending rate for commercial banks unchanged at 6.5 per cent for the second time in succession.

Consequently, the central bank's reverse repo rate has been maintained at 6.25 per cent, and the marginal standing facility (MSF) rate and the bank rate at 6.75 per cent.

The RBI's monetary policy committee (MPC) also made no changes to its stance of "calibrated tightening" adopted in the last policy review conducted in October.

The decision on keeping the policy rate unchanged was taken unanimously by the six-member MPC headed by RBI Governor Urjit R. Patel. However, Ravindra H. Dholakia voted to change the stance to neutral.

According to the RBI, even as inflation projections have been revised downwards significantly and some of the risks pointed out in the last resolution have been mitigated, especially of crude oil prices, several uncertainties still cloud the inflation outlook.

"The MPC noted that the benign outlook for headline inflation is driven mainly by the

unexpected softening of food inflation and collapse in oil prices in a relatively short period of time," Patel said at the post-meeting press conference.

"Excluding food items, inflation has remained sticky and elevated, and the output gap remains virtually closed."

As per the review statement, based on an overall assessment, GDP growth for 2018-19 has been projected at 7.4 per cent (7.2-7.3 per cent in H2) as in the October policy, and for H1:2019-20 at 7.5 per cent, "with risks somewhat to the downside".

"The MPC also noted that even as escalating trade tensions, tightening of global financial conditions and slowing down of global demand pose some downside risks to the domestic economy, the decline in oil prices in recent weeks, if sustained, will provide tailwinds," Patel said.

In addition, the RBI's decision subdued the two key equity indices -- S&P BSE Sensex and NSE Nifty50 -- which traded in the red just minutes after the monetary policy review statement was released.

The BSE S&P Sensex traded lower by over 200 points, while the wider NSE Nifty50 fell by over 86 points.

On the steps to increase liquidity, RBI announced a reduction of SLR (Statutory Liquidity Ratio) from the current 19.5 per cent of net demand and time liabilities (NDTL) to 18 per cent over a period of six quarters starting from the January-March 2019 quarter.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186