Gallery

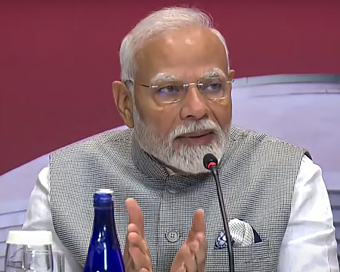

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

Yes Bank scam: Kapoor, family got Rs 600cr kickback as loan Last Updated : 09 Mar 2020 03:42:30 PM IST

Yes Bank founder Rana Kapoor (file photo) The CBI investigation into the case involving Yes Bank founder Rana Kapoor has revealed that he and his family members were paid Rs 600 crore as kickback by DHFL promoter Kapil Wadhwan in the garb of a "builder loan".

It was a part of the criminal conspiracy hatched from April to June 2018 between Rana Kapoor, Wadhwan and others for extending financial assistance to Dewan Housing Finance Limited (DHFL) by Yes Bank Ltd.In lieu of substantial undue benefits to himself and his family members through the companies held by Rana Kapoor, Wadhwan and his family members, the whole conspiracy was hatched, said the CBI First Information Report (FIR) filed on March 7.Yes Bank invested Rs 3,700 crore in the short-term debentures of DHFL for the purpose during the period between April and June 2018, said the FIR which named five companies and seven individuals.Simultaneously, the Central Bureau of Investigation FIR mentioned, Wadhwan paid kickback of Rs 600 crore to Kapoor and his family in the garb of "builder loan". The kickback was given by DHFL to DOIT Urban Ventures (lndia) Pvt Ltd -- a wholly owned subsidiary of RAB Enterprises (lndia) Pvt Ltd in which Rana Kapoor's wife Bindu Kapoor is a director and 100 per cent shareholder.The investigators found that Rana Kapoor's daughters -- Rakhee Kapoor Tandon, Roshni Kapoor and Radha Kapoor -- are also 100 per cent shareholders of DOIT Urban Ventures (lndia) Pvt Ltd through Morgan Credits Private Limited."It has been learnt that the "loan" of Rs 600 crore was sanctioned by DHFL to DOIT Urban Ventures on the basis of mortgage of a sub-standard property with very meagre market value and by considering its future conversion from agricultural land to residential land."As per the FIR, DHFL has not redeemed Rs 3,700 crore invested by Yes Bank in its debentures till date.In addition, it said, Yes Bank also sanctioned a loan of Rs 750 crore to RKW Developers (director Dheeraj Rajesh Kumar Wadhawan) -- a DHFL group company -- for its Bandra-based reclamation project.But, the CBI investigation revealed, the whole amount was siphoned off by DHFL Director Kapil Wadhawan since the entire amount was transferred by RKW Developers to his firm without making investment in Bandra reclamation project for which the loan was sanctioned.Thus, Rana Kapoor obtained undue pecuniary advantage from the DHFL in the matter of investment in the debentures of DHFL by Yes Bank, through the companies held by his wife and daughters.Rana Kapoor allegedly may have similarly misused his official position in several other transactions and obtained illegal kickbacks directly or indirectly through entities controlled by him or his family members, the FIR said.DHFL, DOIT Urban Ventures (lndia) Pvt Ltd, RAB Enterprises (lndia) Pvt Ltd, Morgan Credits Pvt Ltd and RKW Developers Pvt Ltd are among the firms named in the FIR registered on charges of criminal conspiracy, cheating, bribery, abetment of bribery and criminal misconduct.Those named in the FIR are Rana Kapoor, his wife Bindu Rana Kapoor (then director of RAB Enterprises), and their daughters Roshini Kapoor (director of Morgan Credits Pvt Ltd and Doit Urban Ventures), Raakhe Kapoor Tandon (director of Morgan Credits Pvt Ltd) and Radha Kapoor Khanna (director of Morgan Credits Pvt Ltd and Doit Urban Ventures (India) Pvt Ltd.DHFL promoter and director Kapil Wadhwan and Dheeraj Rajesh Kumar Wadhawan (director of RKW Developers Pvt Ltd) are also named along with some unidentified persons.In its FIR, the CBI mentioned that Yes Bank is a private bank governed by the Banking Regulations Act, wherein Section 46-A provides that full-time chairs, Managing Directors and Directors of a banking company are to be considered as public servants.The Supreme Court in its judgment in Ramesh Gelli vs CBI ruled that the office-bearers of a private bank (under Sections 46-A) would be treated as public servants under Section 2(c) of the Prevention of Corruption Act 1988, said the CBI whose BS&FC unit -- a specialised unit which looks into bank fraud cases across the country -- is monitoring the case.The CBI on Monday carried out searches at seven locations in Mumbai in connection with the case a day after Rana Kapoor was arrested by the Enforcement Directorate following over 30 hours of questioning in connection with the probe into a money laundering case involving DHFL.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186