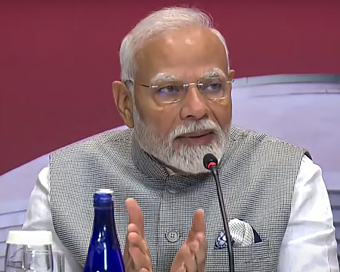

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

Sitharaman lauds RBI rate cut, says need quick transmission Last Updated : 27 Mar 2020 06:11:29 PM IST

Union Finance Minister Nirmala Sitharaman (file photo) After the RBI Governor announced an emergency rate cut on Friday, Union Finance Minister Nirmala Sitharaman lauded the move and stressed the need for lower cost of retail loans and that reduced interest rate needs quick transmission.

Posting on Twitter, Sitharaman said that the three-month moratorium on payments on term-loan installments and interest on working capital would give the much-needed relief amid the national lockdown in view of the coronavirus scare."Appreciate @RBI @DasShaktikanta's reassuring words on financial stability. The 3- month moratorium on payments of term loan instalments (EMI) & interest on working capital give much-desired relief. Slashed interest rate needs quick transmission. #IndiaFightsCoronavirus," the FM said.Appreciate @RBI @DasShaktikanta’s reassuring words on financial stability. The 3 month moratorium on payments of term loan instalments (EMI) & interest on working capital give much-desired relief. Slashed interest rate needs quick transmission. #IndiaFightsCoronavirus

— Nirmala Sitharaman (@nsitharaman) March 27, 2020The Reserve Bank of India on Friday cut the repo rate by 75 basis points to 4.4 per cent. This is the first repo rate cut after the October 2019 monetary policy review.This monetary policy review of the RBI was rescheduled in wake of pandemic which originally scheduled to take place on March 31, 2020 and April 3, 2020, but had to be called held on March 24, 26 and 27 due in view of the coronavirus crisis.As the RBI cuts lending rates, it creates space for banks to reduce interest rates on retail loans, which would eventually help the common man and businesses.Although concerned about the global economy and a growth slowdown in India, RBI Governor Shaktikanta Das said that the macro-economic fundamentals of the Indian economy are sound.Applauding the statement, Sitharaman said in another tweet: "Also welcome @RBI governor @DasShaktikanta's statement: 'The macro-economic fundamentals of the Indian economy are sound, and in fact stronger than what they were in the aftermath of the global financial crisis of 2008-09.' And his timely reminder to #StayCleanStaySafeGoDigital."Applauding the statement, Sitharaman said in another tweet: "Also welcome @RBI governor @DasShaktikanta's statement: 'The macro-economic fundamentals of the Indian economy are sound, and in fact stronger than what they were in the aftermath of the global financial crisis of 2008-09.' And his timely reminder to #StayCleanStaySafeGoDigital." He noted that if the coronavirus pandemic is prolonged and supply chain disruptions get accentuated, the global slowdown could deepen, with adverse implications for India.

He noted that if the coronavirus pandemic is prolonged and supply chain disruptions get accentuated, the global slowdown could deepen, with adverse implications for India.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186