Gallery

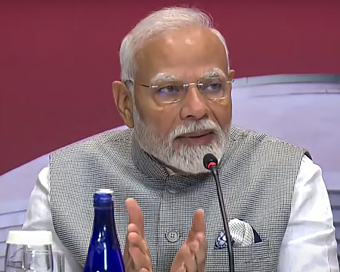

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

GST payers now to fill just 4 GSTR-3B forms instead of 12 Last Updated : 07 Dec 2020 06:12:49 PM IST

File Photo Come January 1 and GST payers would need to fill only 4 GSTR-3B returns in a year instead of 12 returns at present.

C January 1 and GST payers would need to fill only 4 GSTR-3B returns in a year instead of 12 returns at present.In a major reform, the government has eased the return filing experience for the GST taxpayers with the introduction of Quarterly filing of Return with Monthly Payment (QRMP) Scheme.The scheme would impact almost 94 lakh taxpayers, about 92 per cent of the total tax base of the GST, who have an annual aggregate turnover (AATO) up to Rs 5 crore, said sources in the Department of Revenue (DoR).With quarterly scheme put to practice in GST, according to DoR sources, the small taxpayer from January onward would need to file only 8 returns (4 GSTR-3B and 4 GSTR-1 returns) instead of 16 returns at present in a financial year. Also, the taxpayers' professional expenses on return filing would get reduced significantly for they would be required to file just half the number of returns in place of 16 at present.The scheme would be available on the GST common portal with a facility to opt in and opt out and again opt in, if one wishes so.Sources said that this also bring in the concept of providing input tax credit (ITC) only on the reported invoices, thereby put a significant curb on the menace of fake invoice frauds.In the ongoing nationwide drive against fake invoice frauds, the GST intelligence wing DGGI along with the CGST Commissionerates, have so far arrested 114 unscrupulous persons besides booking 1,230 cases against 3,778 fake GSTIN entities.Sources in the know of the matter said that the QRMP scheme has optional feature of Invoice Filing Facility (IFF) to mitigate business related hardships for the small and medium taxpayers.Under the facility of IFF, the small taxpayers who opt to be quarterly return filers under the QRMP scheme would be able to upload and file such invoices even in the first and second month of the quarter for which there is a demand from the recipients.Further, this would engage buyers who earlier used to avoid purchase from the small taxpayers in the want of uploading of invoices in the system on monthly basis.According to sources, that the taxpayer would need not upload and file all the invoices for the month and could upload and file only those invoices which are required to be filed in IFF as per demand of the recipients. The remaining invoices of the first and second months can be uploaded in the quarterly GSTR-1 return. The IFF would be available up to a cut-off date and credit would flow to the recipient after the cut-off date on filing of the IFF.Explaining the reform, sources said that under QRMP scheme, the taxpayer would have the preference to pay their due monthly taxes as per his own choice either by cash ledger or through pre-filled challan which would be 35 per cent of the previous quarter's cash paid or may pay as per actual.Thereby, a small taxpayer would require professional help, as and when required, particularly in the last month of the quarter and can be free from tax-related stress by simply making payment through a system-generated, pre-filled challan.This may also reduce tribulations of late fee, as the pre-filled challan will allow taxpayers to deposit monthly 35 per cent of the cash paid in the previous quarter in the electronic cash ledger.This would be an optional facility available, in place of doing a self-assessment in the first two months of a quarter. Availing this option would imply doing self-assessment only once in a quarter, and would reduce compliance cost for small taxpayers, the source added.The scheme is based on the existing return system with suitable modifications to give much-needed flexibility to small and medium enterprises in relation to compliance under GST and was approved in principle by the GST Council in its 42nd meeting on October 5.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186