Gallery

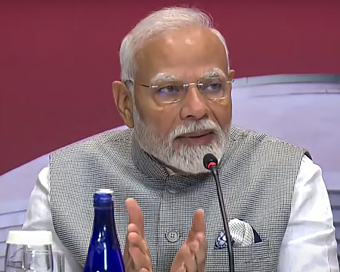

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

Share Market Today: Sensex trims losses, turns green, Nifty 50 above 15700; IndusInd Bank up 3% Last Updated : 04 Jul 2022 11:07:39 AM IST

Domestic stock markets began this week’s trade flat, dancing between marginal gains and losses. S&P BSE Sensex opened in the green but soon slipped into the red, hovering around 52,900. NSE Nifty 50 index was still above 15,700.

Bank Nifty was up 0.50% along with broader markets. India VIX was up 3% touching 22 levels. IndusInd Bank stock was the top gainer on Sensex, followed by Powergrid, Hindustan Unilever, and Sun Pharma. Tata Steel was the top laggard, accompanied by M&M, and TCS.The mega HDFC and HDFC Bank merger has been given the green light by the stock exchanges.In a filing, HDFC Bank informed investors that it has received an observation letter with ‘no adverse observations’ from BSE Limited and an observation letter with ‘no objection’ from the National Stock Exchange of India Limited, both dated July 2, 2022. However, it must be noted that the merger is yet to get a nod from the Reserve Bank of India, Competition Commission of India, and the National Company Law Tribunal. Shareholders and creditors of both HDFC and HDFC Bank are also yet to give their consent for the merger.Earlier in April this year, India’s largest private sector lender HDFC Bank agreed to take over the biggest domestic mortgage lender in a deal valued at about $40 billion.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186