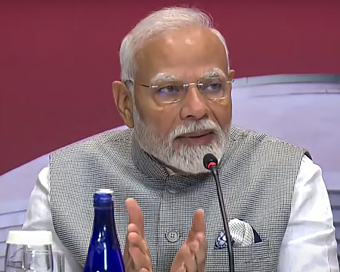

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

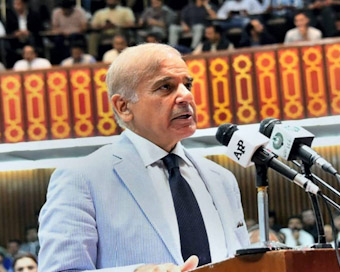

Political instability, economic chaos trigger crisis in Pakistan Last Updated : 02 Aug 2022 05:23:18 PM IST

As political uncertainty continues in Pakistan weeks after the ouster of Imran Khan, this time focused on the province of Punjab, the country’s economic stability has been pushed further into the risk zone with the cabinet approving an ordinance to bypass all procedures for selling assets to foreign countries. The movie is a stop-gap arrangement to prevent the country from defaulting.

Pakistan’s currency has been plummeting against the US dollar and the delay in the release of a crucial $1.17 billion instalment from the International Monetary Fund to Islamabad has also added to the existing economic crisis. The fund earlier this month said it reached a preliminary agreement with Pakistan to revive the $6 billion bailout package. But the deal is subject to approval by the IMF’s executive board.

When Khan was in power, Pakistan’s foreign reserves rose to over $18 billion, which dipped to $10 billion recently. The country’s total debt and liabilities have touched Rs 53.5 trillion which includes the debt of Rs 23.7 trillion under the Khan government. In recent weeks, PM Shahbaz Sharif has slashed subsidies on fuel, electricity and natural gas to meet IMF’s conditions. It has made Sharif’s government highly unpopular and caused a spike in food prices.Many in Pakistan feel that the current coalition government, in the wake of the Punjab bypoll result, could once again resort to “bandaid" approach to fixing the economy. The bypoll was won by ousted PM Imran Khan’s party but the vote for the chief minister in the provincial assembly was marred by allegations of partisan politics.Hamza Sharif, the son of Shahbaz Sharif, remains Punjab CM but Imran Khan’s bloc has decided to go to the Supreme Court against deputy speaker Dost Mohammad Mazari’s decision to invalidate 10 votes in favour of Khan’s candidate Pervez Elahi.The sudden move to sell state assets is being seen as a desperate attempt to save the country from default. The federal cabinet approved the ordinance last week to sell stakes in oil and gas companies and government-owned power plants to the UAE to raise $2 billion to $2.5 billion to avoid the looming default. The UAE had in May refused to give cash deposits due to Pakistan’s failure to return previous loans and instead asked to open its companies for investment.On July 15, the foreign currency reserves held by the State Bank of Pakistan were recorded at $9.32 billion, down $389 million compared with $9.71 billion on July 7, 2022. State Bank of Pakistan’s foreign exchange reserves fell to single digits despite a $2.3 billion inflow from China late last month.The red line for State Bank of Pakistan foreign currency reserves is $7.5 billion to avoid default. If UAE and Saudi or even Chinese withdraw their $2.3 billion, Pakistan’s economy will collapse.For Latest Updates Please-

Join us on

Follow us on

172.31.16.186